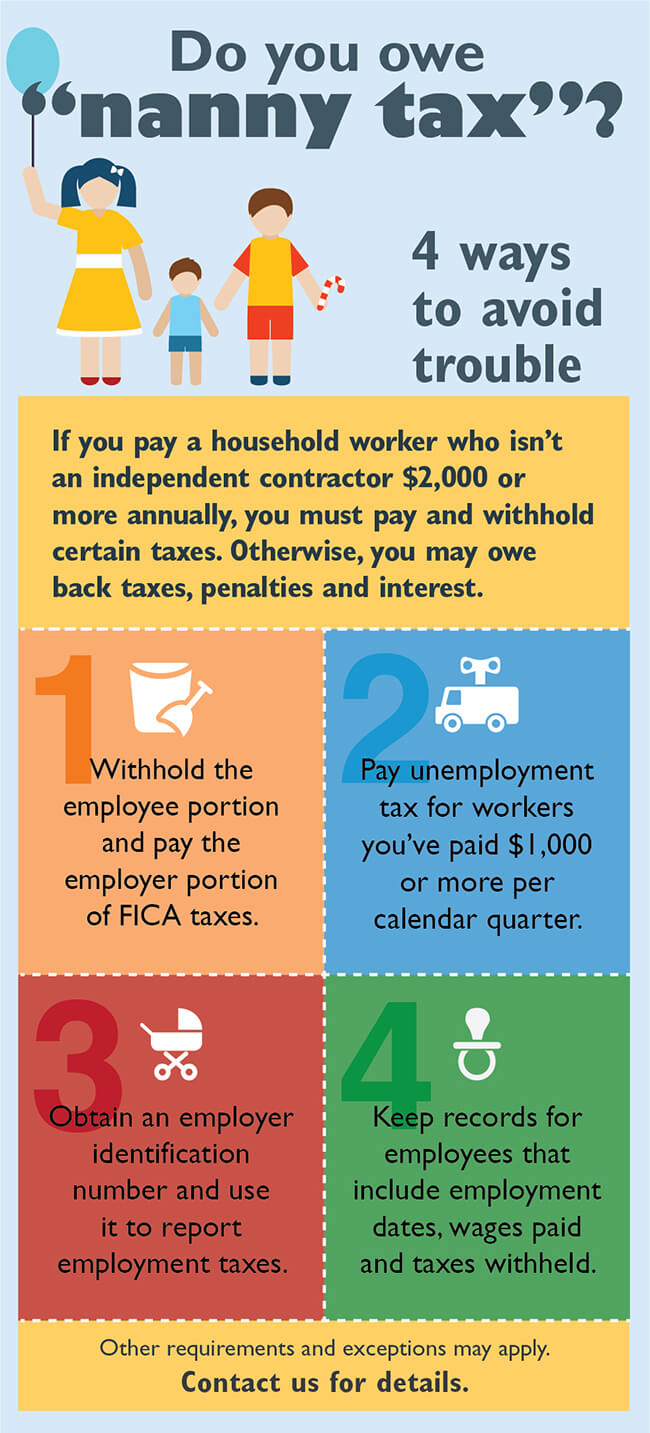

how to avoid paying nanny tax

You generally must pay unemployment tax on the first 7000 of wages you pay each. The net is your nannys take.

Nanny Taxes Made Easy With Poppins Payroll The Mommy Spot Tampa Bay

You can still start right now acquire assets get passive income and eventually be able to avoid paying taxes because of the next tip.

. Apply for Tax ID numbers. Reducing your overall taxable. This is the gross wage.

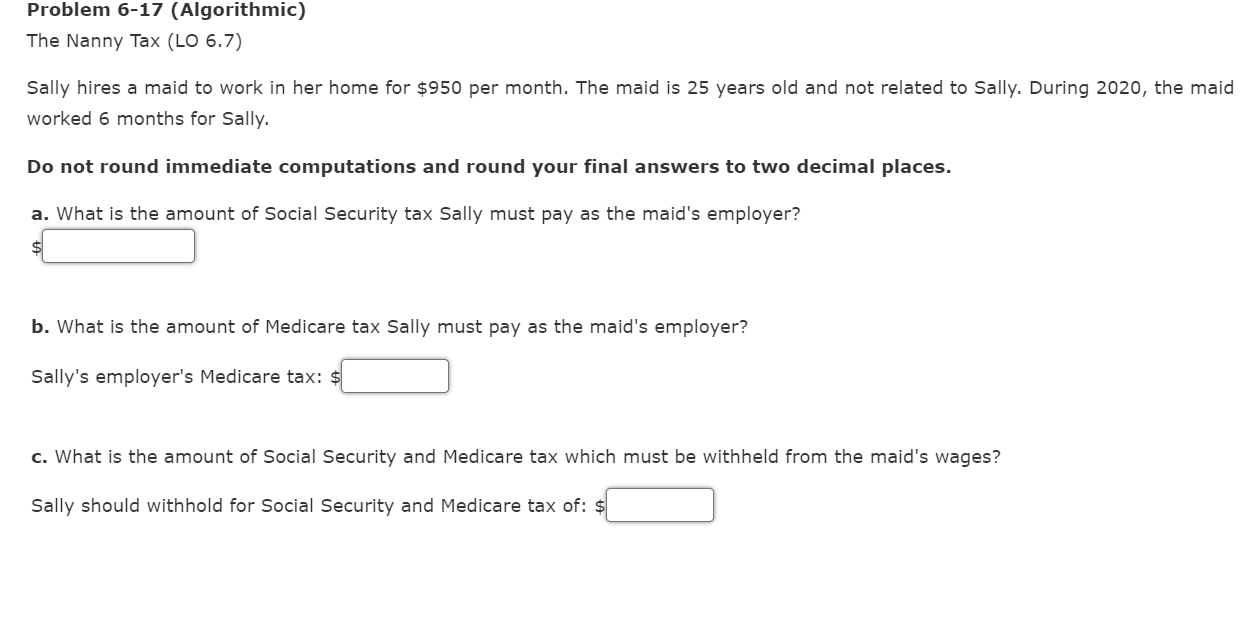

Finding the right nanny can be a huge help. Multiply the number of hours by the hourly wage. But 600 a week gross is in the range of 500 per week.

This lets you set aside up to 10500 of your annual income before taxes and then use that money to pay for child care expenses such as your nannys wages. Make estimated tax payments to the IRS four times a year. Calculate social security and Medicare taxes.

If the parents pay the nanny wages. You dont have to be audited in order to be caught by the IRS. Pay your tax tab to the IRS throughout the year.

If its 600 net after taxes thats around 710-750 gross assuming the basic claim amounts depending on the province. There are four main action items that families need to take care of. Nanny Tax Exceptions.

Along with having a nanny though comes the added responsibility of nanny payroll and handling nanny taxes if you paid them. Subtract Social Security and Medicare taxes income taxes and any other state or local taxes that may apply generally about 10 percent of gross pay. To avoid your nanny having a large tax bill at year end its a good idea to withhold income taxes.

Like other employers parents must pay certain taxes. If your employee files for unemployment benefits after her employment with you ends and you havent paid your state. Mandatory Tax Forms Form W-2 You must provide your household.

Yes in most cases you can pay all the taxes you owe at one time. Now lets get into the process of actually managing nanny taxes. To manage your federal household employment taxes the IRS recommends you make estimated tax payments.

But a better idea to avoid underpayment penalties or getting socked with a. This software not only simplifies paying your household employee but it also can even tackle complicated tax calculations allow you to direct deposit your nannys pay track. You and your employee each pay 765 percent of gross.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and. Take Passive Losses Acquiring. How to pay nanny taxes.

Its required if your total household salaries are 1000 or more in any calendar quarter. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return.

How To Pay A Nanny The Right Way Nanny Taxes Paperwork And More

Do You Owe Nanny Tax Yeo And Yeo

Nanny Taxes How To Pay Taxes For A Household Employee

How To Reduce Your Nanny Taxes Aunt Ann S In House Staffing

Solved Problem 6 17 Algorithmic The Nanny Tax Lo 6 7 Chegg Com

Hiring Grandma To Be A Nanny Robergtaxsolutions Com

Nanny Tax Rules How You Know If You Owe Payroll Taxes For Someone Who Works In Or Around Your Home

A Guide To Nanny Tax Compliance For Accountants And Their Clients

Paying Your Nanny Legally In Texas The First Milestones

6 Household Employment Mistakes And How To Avoid Them Care Com Homepay

Guest Column Nanny Tax Should Be Killed Or Cured

Everything You Need To Know About How To Pay A Nanny In 2022

Nanny Tax Scenarios For Nanny S And Family Caregivers

Not Worth The Risk The Very Real Possibility Of Losing Clients Over Nanny Tax Issues

We Hired A Nanny Now What About The Taxes Accredited Investors

What Is The Nanny Tax And How Do I Pay It For Household Employees

Opinion Paying Nanny Taxes Is A Nightmare And Intuit Isn T Helping Deseret News

Household Help Could Mean More Tax Work For Employers Don T Mess With Taxes

:max_bytes(150000):strip_icc()/IsItOKToPayMyNannyinCash-4d00db8cf26f4f7a99abbfa0670e8ce5.jpg)